Why are people on the move?

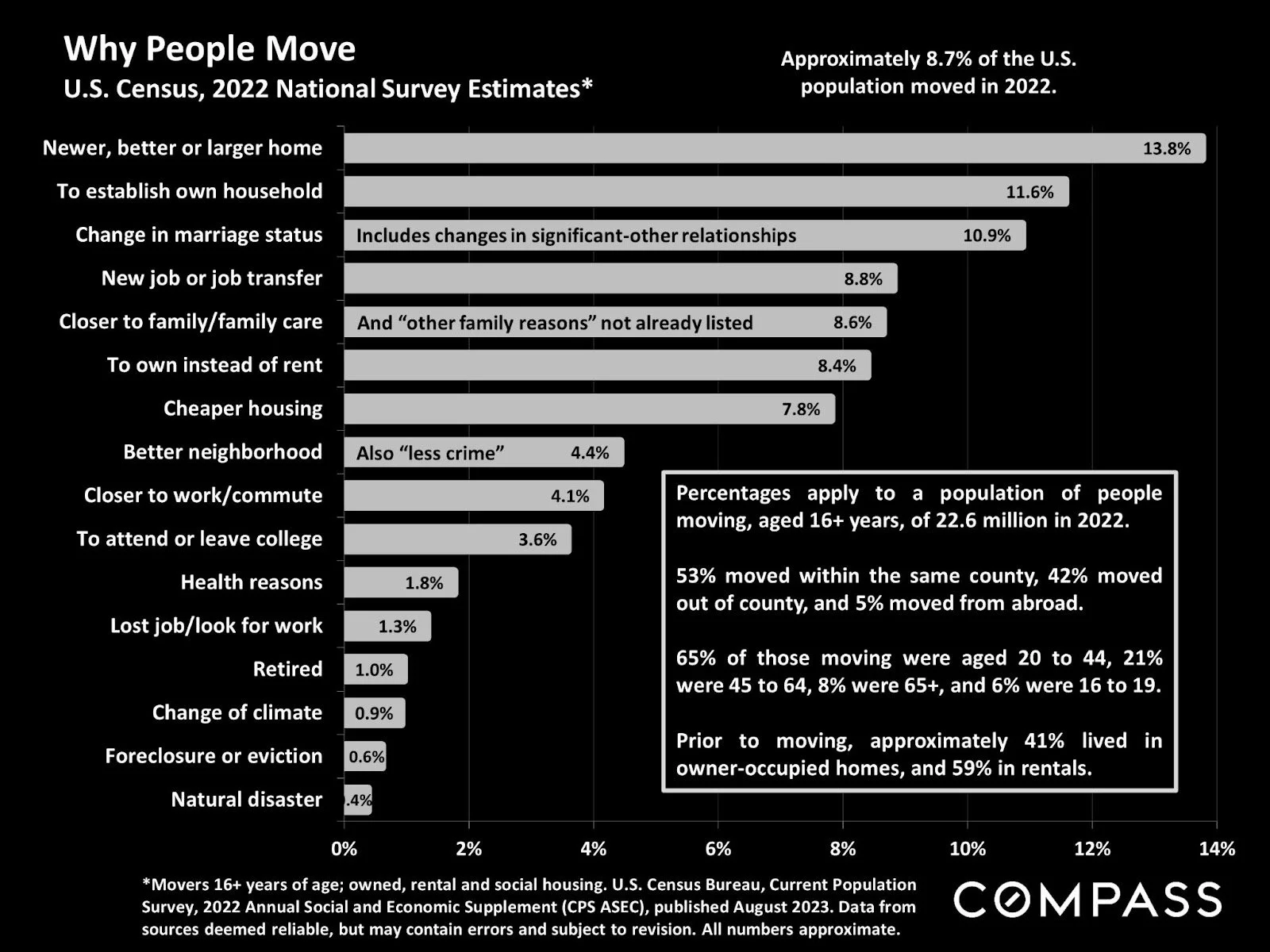

/According to the U.S. Census, Americans are on the move, with 8.7% of the population changing their environment in 2022 alone. Why? There are a number of factors. The aspiration to move from renting to owning is part of everyone’s home dreams. Proximity to family is also a critical component, especially with the cost of childcare. And of course, housing affordability and the cost of living are also huge factors.

It’s interesting to note that young people and seniors are the most motivated demographics to move, and for many of the same reasons like new jobs and career opportunities. Check the numbers for additional insights.