Chic vs. Geek: Opportunity is knocking...

/We know single family home sales are up during the pandemic, but how’s it going on the condo and townhome market?

Read MoreWe know single family home sales are up during the pandemic, but how’s it going on the condo and townhome market?

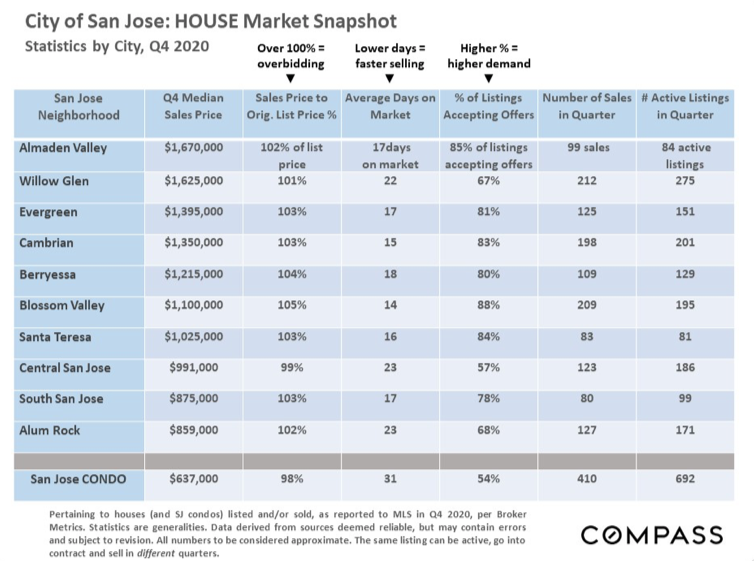

Read MoreThe tables below reflect market statistics and values for Q4 2020. It’s no surprise that we saw a hot finish to 2020 as final quarter numbers are often starkly different from stats for the full year. It’s also not unusual for more expensive markets to have softer supply and demand statistics — such as higher average days on the market and lower percentages of listings accepting offers within the period — though this is certainly not always the case.

According to a new survey from realtor.com, 47% of first-time homebuyers in 2020 said the most important factor in their decision was their personal finances, and more than two-thirds (68%) were surprised by what they could afford — more or less. Read more from Forbes.

With mortgage rates at record lows, millennial buyers are taking advantage. In fact, they were responsible for a majority of the record number of mortgage applications in 2020. As reported by Forbes, San José was the most popular metropolitan landing spot for millennial homebuyers. Rounding out the top 10: Boston, Denver, Minneapolis, Buffalo, San Francisco, Salt Lake City, Austin, Pittsburgh, and New York City.

A variety of factors can affect home values — location, architectural style, curb appeal, square footage, condition, views, amenities, extra rooms, parking, decks and yards, privacy, lot size, demographics, environmental factors, and so on. And there is typically a wide or even vast spectrum of homes in any given market area, especially a large one like the Bay Area. This can lead to mean or average values that don’t tell the full story because of fluctuations at either end.

That’s why it’s important to look at median values, which fall smack in the middle of all sales. Median values can be affected by factors unrelated to fair market value, and anomalous fluctuations are common, especially in smaller and/or very expensive markets over shorter time periods. But over the long term, they are a much more reliable indicator of actual market value.

Without a specific comparative market analysis, it can be hard to know the factors impacting a particular property. For example, looking at these charts, median house values for Napa and Sonoma Counties were limited to homes on lots of two acres or less. Not every town or city within the Bay Area is included here, so please contact us for more!